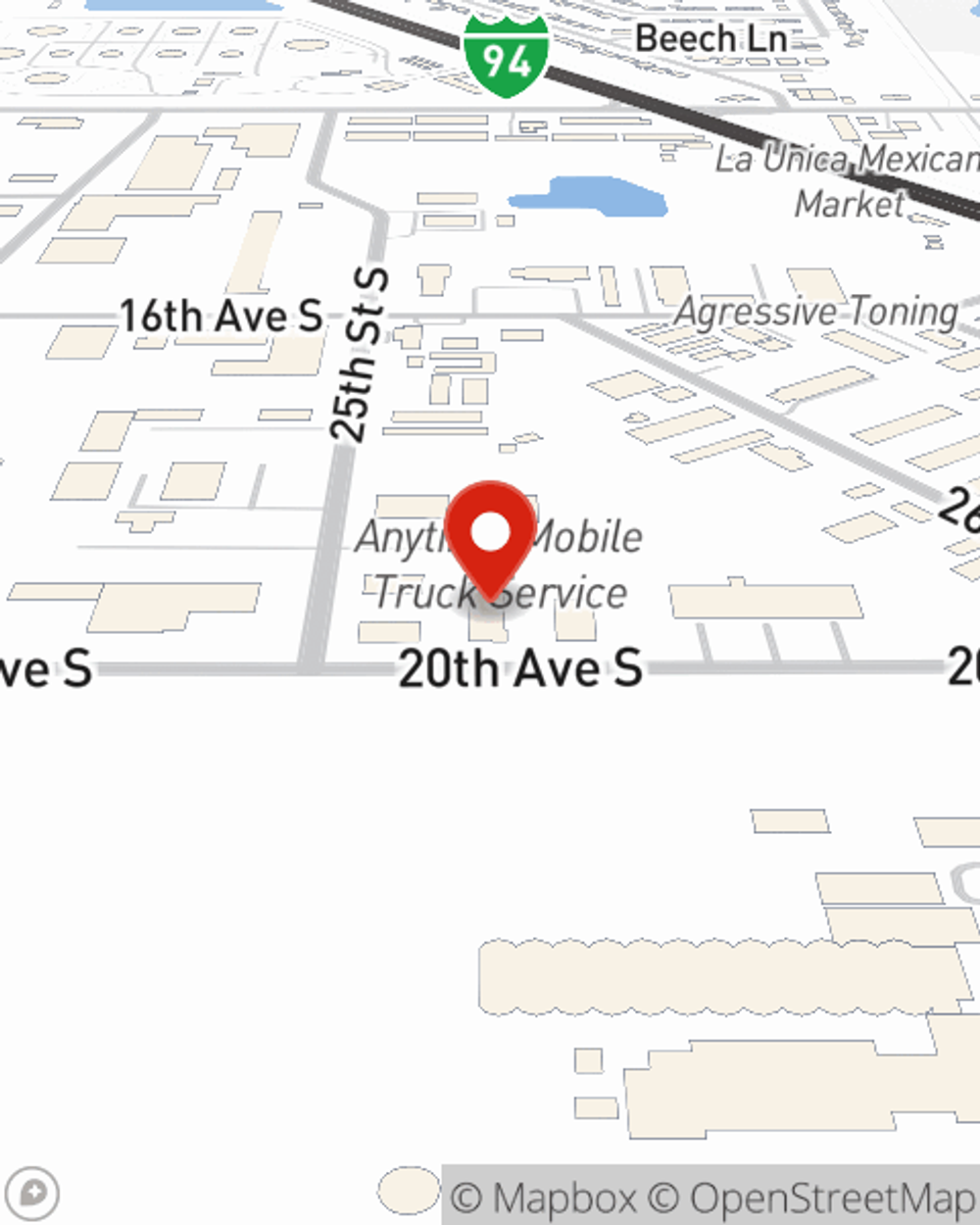

Business Insurance in and around Moorhead

Moorhead! Look no further for small business insurance.

Cover all the bases for your small business

- Barnesville MN

- Moorhead MN

- Fargo ND

- West Fargo ND

- Pelican Rapids MN

- Rothsay MN

- Rollag MN

- Detroit Lakes MN

- Glyndon MN

- Dilworth MN

- Minnesota

- North Dakota

- South Dakota

- Iowa

- Wisconsin

Insure The Business You've Built.

Running a small business comes with a unique set of wins and losses. You shouldn't have to deal with those alone. Aside from just your family and friends, let State Farm be part of your line of support through insurance options including errors and omissions liability, worker's compensation for your employees and business continuity plans, among others.

Moorhead! Look no further for small business insurance.

Cover all the bases for your small business

Strictly Business With State Farm

Your company is special. It's where you make your living and also how you make a life—for yourself but also for your loved ones, and those who work for you. It’s more than just an office or a store. Your business is a reflection of all your hopes and dreams. Doing what you can to keep it safe just makes sense! A next great step is to get outstanding small business insurance from State Farm. Small business insurance covers a wide range of occupations like an optometrist. State Farm agent Saad Janjua is ready to help review coverages that fit your business needs. Whether you are a sporting goods store, a hair stylist or a physician, or your business is a bagel shop, an acting school or a music school. Whatever your do, your State Farm agent can help because our agents are business owners too! Saad Janjua understands the unique needs you have and is ready to review coverages that meet your needs. With State Farm, you’ll be ready to grow your business into a bright future.

Ready to review the business insurance options that may be right for you? Reach out agent Saad Janjua's office to get started!

Simple Insights®

Ways to help set financial goals

Ways to help set financial goals

As a business owner, your financial goals should be split into two worlds: one set for your business and another for your personal life.

How to hire employees for small business

How to hire employees for small business

Discover helpful strategies on how to hire skilled employees for your small business and learn how to attract and retain the right talent for your growing company.

Saad Janjua

State Farm® Insurance AgentSimple Insights®

Ways to help set financial goals

Ways to help set financial goals

As a business owner, your financial goals should be split into two worlds: one set for your business and another for your personal life.

How to hire employees for small business

How to hire employees for small business

Discover helpful strategies on how to hire skilled employees for your small business and learn how to attract and retain the right talent for your growing company.